argenx SE (Euronext & Nasdaq: ARGX), a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases, today announced its third quarter 2022 financial results and provided a business update and outlook for the remainder of the year.

“We had a strong third quarter of our global VYVGART launch now underway in our priority territories of the U.S., Japan and the EU. I am proud of what our teams have achieved, working cross-functionally to set a new treatment standard in gMG and serve as many patients as possible. Looking ahead, we are ready to support a SC efgartigimod launch in the first half of 2023 so that gMG patients can have multiple ways to individualize their treatment,” said Tim Van Hauwermeiren, Chief Executive Officer of argenx. “gMG is also just the beginning and we are committed to advancing our immunology pipeline of efgartigimod, ARGX-117 and ARGX-119 with eight ongoing clinical trials in severe autoimmune diseases and more to start by the end of the year. We believe we are well on our way to realizing our goal of becoming a leading, multi-product immunology company and that we have the right team, a differentiated pipeline, and a sustainable discovery engine to continue innovating on behalf of patients.”

THIRD QUARTER 2022 AND RECENT BUSINESS UPDATE

VYVGART Launch

VYVGART is the first-and-only approved neonatal Fc receptor (FcRn) blocker in the U.S., Japan and the European Union (EU). VYVGART is approved in the United States (U.S.) and the EU for the treatment of adult gMG patients who are anti-acetylcholine receptor (AChR) antibody positive and in Japan for adult gMG patients who do not have sufficient response to steroids or non-steroidal immunosuppressive therapies (ISTs).

- Generated global net VYVGART revenues of $131 million in the third quarter of 2022

- Received European Commission (EC) approval on August 11, 2022; commercial launch in Germany initiated on September 1, 2022

- Approval decisions expected in 2023 in Canada, China through Zai Lab, and Israel through Medison

- Expanded large-scale manufacturing capabilities and capacity through collaboration with FUJIFILM Diosynth Biotechnologies to provide drug substance manufacturing of efgartigimod

Efgartigimod Research and Development

argenx is positioned to expand its leadership position in FcRn blockade to include ten total autoimmune indications in the pipeline by the end of 2022

- Neuromuscular franchise

- Submitted BLA to the U.S. Food and Drug Administration (FDA) for SC efgartigimod for gMG; approval decision and commercial launch expected in first half of 2023

- Topline data from registrational ADHERE trial of SC efgartigimod for chronic inflammatory demyelinating polyneuropathy (CIDP) on track for first quarter of 2023

- Registrational ALKIVIA trial ongoing of SC efgartigimod for three subtypes of idiopathic inflammatory myopathies (myositis), including immune-mediated necrotizing myopathy, anti-synthetase syndrome and dermatomyositis; interim analysis planned of first 30 patients of each subtype

- Hematology franchise

- Topline data from second registrational ADVANCE-SC trial of SC efgartigimod for primary immune thrombocytopenia (ITP) expected in second half of 2023

- Dermatology franchise

- Topline data from registrational ADDRESS trial of SC efgartigimod for pemphigus vulgaris and foliaceus expected in second half of 2023

- Registrational BALLAD trial ongoing of SC efgartigimod for bullous pemphigoid with interim analysis planned of first 40 patients

- Proof-of-concept trials to launch in 2022 in collaboration with Zai Lab and IQVIA

- Zai Lab to launch trials in lupus nephritis and membranous nephropathy with argenx to lead global registrational programs for each potential indication

- IQVIA to launch trial in primary Sjogren’s syndrome; trial ongoing in COVID-19- mediated postural orthostatic tachycardia syndrome (POTS)

Pipeline Progress

argenx is developing ARGX-117 and ARGX-119, which both have pipeline-in-a-product potential for multiple autoimmune indications. Additional candidates that emerged from the Immunology Innovation Program are in development by partners or spin-off companies.

- ARGX-117 (C2 inhibitor)

- Proof-of-concept ARDA trial ongoing to evaluate safety, tolerability, and potential dosing regimen in multifocal motor neuropathy (MMN)

- Proof-of-concept trial expected to start following regulatory discussions for prevention of delayed graft function and/or allograft failure after kidney transplantation

- ARGX-119 (muscle-specific kinase (MuSK) agonist)

- Phase 1 dose-escalation trial in healthy volunteers expected to start after Clinical Trial Application filing in fourth quarter of 2022 with subsequent Phase 1b trial to assess early signal detection in patients

- LEO Pharma exercised exclusive, worldwide option to ARGX-112 targeting IL22 receptor; decision triggered €5 million payment to argenx

Hans de Haard, Ph.D. to retire as CSO on January 1, 2023 and transition to consultant within Immunology Innovation Program and strategic advisor to Research and Development Committee of argenx Board of Directors

- Succession plans underway for Peter Ulrichts, Ph.D., Head of Clinical Science at argenx, to assume CSO role

Nomination of Ana Cespedes as non-executive director to Board of Directors

Ana Cespedes’s appointment is pending approval, which is expected to occur at an extraordinary general meeting of shareholders to be held in December 2022. She is Chief Operating Officer of IAVI, a global organization dedicated to developing accessible vaccines and antibodies for infectious diseases. She brings robust experience across a broad range of critical areas for commercialization and access, as well as for organizational effectiveness.

THIRD QUARTER 2022 FINANCIAL RESULTS

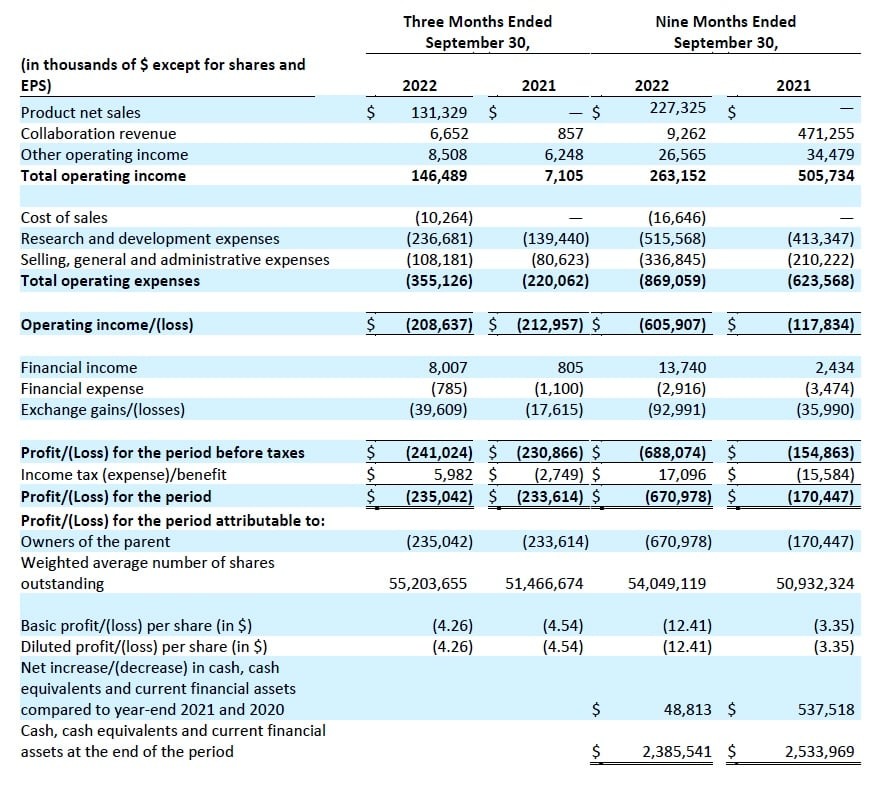

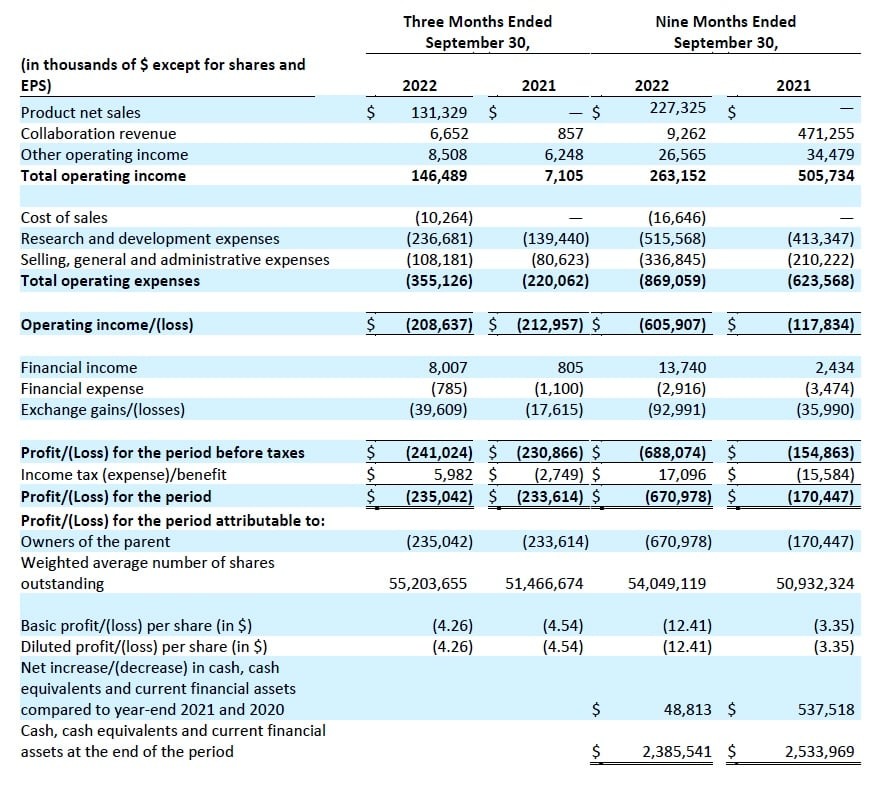

ARGENX SE

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENT OF PROFIT OR LOSS

DETAILS OF THE FINANCIAL RESULTS

Total operating income for the third quarter and year-to-date in 2022 was $146.5 million and $263.2 million, respectively, compared to $7.1 million and $505.7 million for the same periods in 2021, and consists of:

- Product net sales from the sales of VYVGART for the three months ended September 30, 2022 were $131.3 million. The product net sales in the nine months ended September 30, 2022 were $227.3 million. No product net sales were recognized during the same period in 2021.

- Collaboration revenue for the third quarter and year-to-date in 2022 was $6.7 million and $9.3 million, respectively, compared to $0.1 million and $471.3 million for the same periods in 2021. The collaboration revenue during the three months ended September 30, 2022 primarily relates to milestone revenue of the €5 million triggered by the option exercised by LEO Pharma to enter into a commercial license for ARGX-112. The collaboration revenue for the three and nine months ended September 30, 2021 was primarily attributable to the recognition of the transaction price as a consequence of the termination of the collaboration agreement with Janssen, resulting in the recognition of $315.1 million and the closing of the strategic collaboration for efgartigimod with Zai Lab, resulting in the recognition of $151.9 million in collaboration revenue.

- Other operating income for the third quarter and year-to-date in 2022 was $8.5 million, and $26.6 million, respectively, compared to $6.2 million and $34.5 million for the same periods in 2021. During the nine months ended September 30, 2022, and September 30, 2021, the fair value of the argenx profit share in AgomAb Therapeutics NV increased by $4.3 million and $11.2 million respectively. The increase is a result of the extension of a Series B financing round by AgomAb for which argenx maintains a profit share in exchange for granting the license for the use of HGF-mimetic antibodies from the SIMPLE Antibody™ platform.

Total operating expenses for the third quarter and year-to-date in 2022 were $355.1 million and $869.1 million, respectively, compared to $220.1 million and $623.6 million for the same periods in 2021, and consists of:

- Cost of sales for the third quarter and year-to-date in 2022 was $10.3 million and $16.6 million, respectively. The cost of sales were recognized with respect to the sale of VYVGART during 2022. There were no cost of sales recognized in the comparable prior year periods.

- Research and development expenses for the third quarter and year-to-date in 2022 were $236.7 million and $515.6 million, respectively, compared to $139.4 million and $413.3 million for the same periods in 2021. The research and development expenses mainly relate to external research and development expenses and personnel expenses incurred in the clinical development of efgartigimod in various indications and the expansion of other clinical and preclinical pipeline candidates. The increase in research and development expense during the third quarter 2022 is mainly driven by the recognition of the priority review voucher submitted with the BLA filing for SC efgartigimod for the treatment of gMG, which resulted in an expense of $99.1 million.

- Selling, general and administrative expenses for the third quarter and year-to-date in 2022 were $108.2 million and $336.8 million, respectively, compared to $80.6 million and $210.2 million for the same periods in 2021. The selling, general and administrative expenses mainly relate to professional and marketing fees linked to the commercialization of VYVGART in the U.S., Japan and the EU and personnel expenses.

Exchange losses for the third quarter and year-to-date in 2022 were $39.6 million and $93.0 million, respectively, compared to $17.6 million and $36.0 million for the same periods in 2021. Exchange losses are mainly attributable to unrealized exchange rate losses on cash, cash equivalents and current financial assets position in Euro.

Income tax for the third quarter and year-to-date in 2022 was $6.0 million and $17.1 of tax income, respectively, compared to $2.7 million and $15.6 million of tax expense for the same periods in 2021. Tax income for the three months ended September 30, 2022 consists of $7.3 million of income tax expense and $13.3 million of deferred tax income, compared to $4.3 million of income tax expense and $1.6 million of deferred tax income for the same period in 2021.

Net loss for the third quarter and year-to-date in 2022 was $235.0 million and $671.0 million, respectively, compared to net loss of $233.6 million and $170.4 million for the same periods in 2021.

Cash, cash equivalents and current financial assets totaled $2,385.5 million as of September 30, 2022, compared to $2,336.7 million as of December 31, 2021. Cash and cash equivalents and current financial assets increased primarily as a result of the closing of a global offering of shares, which resulted in the receipt of $761.0 million in net proceeds in March 2022, offset by net cash flows used in operating activities.

FINANCIAL GUIDANCE

Based on current plans to fund anticipated operating expenses and capital expenditures, argenx continues to expect its 2022 cash burn to be up to $1 billion. This will support the global VYVGART launches, clinical development of efgartigimod in 10 indications and ARGX-117 in two indications, investment in the global supply chain, and continued focus on pipeline expansion through the Immunology Innovation Program.

EXPECTED 2023 FINANCIAL CALENDAR

- March 2, 2023: FY 2022 financial results and business update

- May 4, 2023: Q1 2023 financial results and business update

- July 27, 2023: HY 2023 financial results and business update

- October 27, 2023: Q3 2023 financial results and business update

CONFERENCE CALL DETAILS

The third quarter 2022 financial results and business update will be discussed during a conference call and webcast presentation today at 2:30 pm CEST/8:30 am ET. A webcast of the live call may be accessed on the Investors section of the argenx website at argenx.com/investors. A replay of the webcast will be available on the argenx website.

Dial-in numbers:

Please dial in 15 minutes prior to the live call.

Belgium

| 32 800 50 201

|

United Kingdom

| 44 800 358 0970

|

United States

| 1 888 415 4250

|

All other locations

| 1 646 960 0294

|

About argenx

argenx is a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases. Partnering with leading academic researchers through its Immunology Innovation Program (IIP), argenx aims to translate immunology breakthroughs into a world-class portfolio of novel antibody-based medicines. argenx developed and is commercializing the first-and- only approved neonatal Fc receptor (FcRn) blocker in the U.S., Japan and the EU. The Company is evaluating efgartigimod in multiple serious autoimmune diseases and advancing several earlier stage experimental medicines within its therapeutic franchises. For more information, visit www.argenx.com and follow us on LinkedIn, Twitter, and Instagram.

For further information, please contact:

Media:

Kelsey Kirk kkirk@argenx.com

Investors:

Beth DelGiacco bdelgiacco@argenx.com

Forward-looking Statements

The contents of this announcement include statements that are, or may be deemed to be, “forward- looking statements.” These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “hope,” “estimates,” “anticipates,” “expects,” “intends,” “may,” “will,” or “should” and include statements argenx makes regarding the VYVGART launch strategy to make VYVGART available in the EU, China, Canada and select other regions, the approval and commercial launch following the submission of the Biologics License Application to the U.S. Food and Drug Administration for Subcutaneous (SC) Efgartigimod for Treatment of Generalized Myasthenia Gravis and the long-term safety and tolerability of SC Efgartigimod; Zai Lab and Medison’s respective pending approvals in China and Israel; its position to expand its leadership position in FcRn blockade to include ten autoimmune indications by the end of 2022; the therapeutic potential of its product candidates; the intended results of its strategy and its collaboration partners’, advancement of, and anticipated clinical development and regulatory milestones and plans, including the timing of planned clinical trials; the design of future clinical trials and the timing and outcome of regulatory filings and regulatory approvals; its expectation that its 2022 cash burn will be up to $1 billion and the 2022 business and financial outlook and related plans. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that any such forward-looking statements are not guarantees of future performance. argenx’s actual results may differ materially from those predicted by the forward-looking statements as a result of various important factors, including the effects of the COVID-19 pandemic, inflation and deflation and the corresponding fluctuations in interest rates; regional instability and conflicts, such as the conflict between Russia and Ukraine, argenx’s expectations regarding the inherent uncertainties associated with competitive developments, preclinical and clinical trial and product development activities and regulatory approval requirements; argenx’s reliance on collaborations with third parties; estimating the commercial potential of argenx’s product candidates; argenx’s ability to obtain and maintain protection of intellectual property for its technologies and drugs; argenx’s limited operating history; and argenx’s ability to obtain additional funding for operations and to complete the development and commercialization of its product candidates. A further list and description of these risks, uncertainties and other risks can be found in argenx’s U.S. Securities and Exchange Commission (SEC) filings and reports, including in argenx’s most recent annual report on Form 20-F filed with the SEC as well as subsequent filings and reports filed by argenx with the SEC. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. argenx undertakes no obligation to publicly update or revise the information in this press release, including any forward-looking statements, except as may be required by law.